Page 83 - MELLBY_MAGASIN_2021_EN

P. 83

JOHAN ANDERSSON

Tips for raising capital

When you’re an entrepreneur, you always want your ideas to take flight

and your business to grow. But there are times when you might need a

little help. In that case, it might be worth looking at the option of raising

external capital from one or more investors so as to ensure growth and

continued operations. But how do you go about raising capital?

Johan Andersson, CEO of Mellby Gård, has a series of tips to help PITCH WHAT YOU HAVE TO OFFER

entrepreneurs who are just starting out to raise capital. The first When these things are all in place, it’s time to build up your pitch

thing he points to as key is to have a business model that is proven to investors. There are lots of things to take into account here too,

and works in practice, that you have your first customers and know what according to Johan.

kind of investors you want to partner with. Secondly, it is important to

find an investor who believes in the entrepreneur and the idea and sees “Personally, I’m impressed when people have given plenty of thought

the potential in it. to as many parameters as possible. Sometimes, it’s clear to me that

there’s just too much emphasis on simply building volume and getting

“When you’re ready to raise capital, I think you have to be able to customers, and this business of profitability trails in second place. A

present some form of track record for your business so that investors lot hinges on pricing, and that’s something I focus on extensively – just

know what they’re getting. Then there’s no doubt that the entrepreneur making sure you’ve really thought about where to pitch your product

and the team behind the company are every bit as important as the in terms of price. Because it’s only then you’ll know whether you can

business concept – that as an investor, I believe in the people who run build up a company that’s healthy and sustainable in the long term.

the company.”

“After that, it’s important to make sure you’ve carried out a

SCALABILITY CRUCIAL thorough analysis of your competitors. Many entrepreneurs start up

Next, it’s important to define what kind of support you need in your businesses in sectors that are already accommodating a number of

capacity as an entrepreneur. Johan feels it’s important for the capital smaller companies, or sometimes big ones. So it’s important to ask

to be earmarked for something specific that can help the company to yourself over and over: if we make a success of this, what will our

grow, such as marketing, developed IT systems or more personnel. It’s competitors in this industry do?”

also important to define expectations for the partnership.

COMMON PITFALLS

“As I see it, the most important quid pro quo is that as an investor, Before pitching to investors, there are also a series of pitfalls that

you feel the entrepreneurs responsible for the company are taking entrepreneurs have to watch out for. Johan highlights the fact that lots

a big risk themselves. That helps you feel a greater sense of shared of entrepreneurs have too narrow a time horizon for their companies,

ownership, and that the entrepreneur is going all-in on this particular and too early an exit plan.

project and not focusing on loads of other things.”

“I think entrepreneurs focus too much on exit at times. You receive

Fourthly, Johan highlights the importance of having a scalable a pitch, and on the second page you see “we are planning to sell the

business model so that it becomes profitable and applicable in the company at a very high value in four to five years’ time”. Thinking

long term even though it’s not cheap to build up initially. This is linked along these lines isn’t wrong, but it doesn’t impress me. I like to see

to how you go about building up a critical mass of customers, how you people taking a long-term approach, and if you’ve gone to the effort of

price your products and services, and how the initial sales process founding a company, I’d at least like to feel that the entrepreneurs are

works in practice. You can work on the basis of that and gradually in it for the long haul.”

streamline and expand your activities.

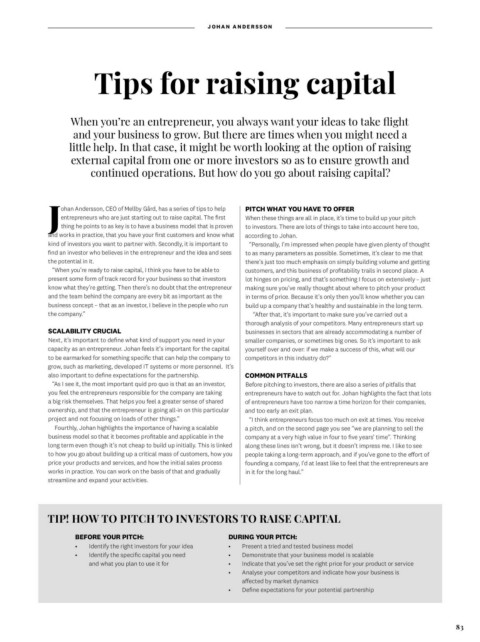

TIP! HOW TO PITCH TO INVESTORS TO RAISE CAPITAL

BEFORE YOUR PITCH: DURING YOUR PITCH:

• Identify the right investors for your idea • Present a tried and tested business model

• Identify the specific capital you need • Demonstrate that your business model is scalable

• Indicate that you’ve set the right price for your product or service

and what you plan to use it for • Analyse your competitors and indicate how your business is

affected by market dynamics

• Define expectations for your potential partnership

83