Page 30 - SKR-annual-report-2022-EN

P. 30

30 FINANCES

Modest losses

in difficult times

World events are creating uncertainty, but the Finnish Cultural Foundation’s

operations are secured even in weaker economic times.

ccelerating inflation, the There were EUR 17.1 million in capital of donations for distribution includes

energy crisis caused by the gains from the sale of assets, of EUR 6.1 million in funds earmarked

war in Ukraine, and tight- which EUR 4.0 million were directed for the New Classics fund, which the

towards strengthening the founda- Government of Finland, the Swedish

ening monetary policy generated a tion’s working capital. The sum went Cultural Foundation in Finland, the

negative environment for all asset to the general funds of the Cultural Alfred Kordelin Foundation, and the

classes in the past year. At the end of Foundation’s regional funds. Account- Jenny and Antti Wihuri Foundation

the operating year, the fair value of the ing for capital gains, the Foundation’s transferred to the Finnish Cultural

Finnish Cultural Foundation’s assets income from investments and received Foundation for separate management.

was EUR 1.806 billion, of which invest- donations for distribution exceeded During the financial year, 11 donor

ment assets accounted for EUR 1.624 the payment of grants and expenses funds were established, five of them

billion. The return on the investment from other statutory operations by under the Cultural Foundation’s

portfolio during the period was −5.9%, EUR 20.6 million. central fund and six under its regional

compared to the benchmark return funds. As of 30 September 2022, the

of −8.6%. Diversification into unlisted A total of EUR 17.6 million was Foundation was managing 890 funds.

investments compensated for the weak received in donations and bequests, of

development of listed investments. which EUR 10.8 million were capital The major challenges for the period

donations and EUR 0.7 million were under review were accelerating

The accounts show a surplus for for distribution. Additionally, the sum

the financial year of EUR 6.4 million.

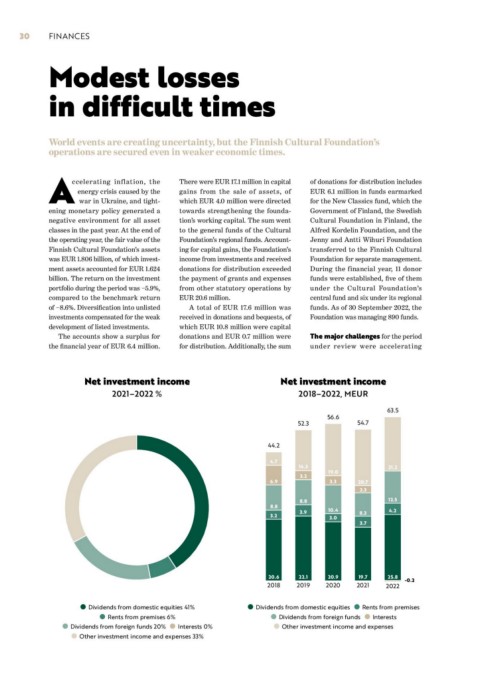

Net investment income Net investment income

2021–2022 % 2018–2022, MEUR

63.5

56.6

52.3 54.7

44.2

4.7

14.3 21.2

19.0

3.2

6.9 3.3 20.7

2.3

8.8 12.5

8.8 3.9 10.4 8.3 4.2

3.2 3.0

3.7

20.6 22.1 20.9 19.7 25.8 -0.2

2018 2019 2020 2021 2022

● Dividends from domestic equities 41% ● ●Dividends from domestic equities Rents from premises

● Rents from premises 6% ● ●Dividends from foreign funds Interests

● Other investment income and expenses

● ●Dividends from foreign funds 20% Interests 0%

● Other investment income and expenses 33%