Page 31 - SKR-annual-report-2022-EN

P. 31

31

inflation and the war in Ukraine, The climate for equity investments which evened out the drop in the

including its impact on the European was challenging in the period. At markets. The return on fixed-income

energy market. Although the first the index level, most equity markets investments was −2.8%, with the

signs of rising inflation were seen in recorded double-digit dives. In Europe, benchmark at −9.4%.

the aftermath of the Covid pandemic, equity markets were down by −10.7%;

inflation was long expected by the in Finland, by −16.8%. Euro investors The return on the portfolio as a

central banks and markets to remain benefited from the strength of the whole was balanced by alternative

a temporary phenomenon. After the dollar during the year, however, thanks investments, whose return was

summer, the market seemed to have to which North American stocks positive by 18.7%. Valuation changes in

a clear interpretation of the direction experienced a more moderate decline the liquid assets market have not as yet

that monetary policy would take: The of −1.1% when calculated in euros. The had a strong impact on the valuation

Fed and the ECB had decided to tackle driver behind the negative returns of unlisted companies. Real estate

inflation with interest rate raises, even was tightening monetary policy and investments had a return of 1.6%.

if this might bring on a recession. subsequent changing valuation levels,

cost inflation, and weakened economic The greatest uncertainties in

Russia’s attack on Ukraine brought prospects. The Cultural Foundation’s the near future are linked to the

a sorry turn to the financial year. The equity investments were down by development of the global economy

importance of Russian natural gas is −14.0%, compared to the benchmark and investment market. Accelerating

huge for Germany and thereby for other at −14.2%. inflation and strong interest rate

European economies, and alternative hikes by central banks coupled with

energy sources are not readily available. Fixed-income investments brought weakening economic prospects

The energy crisis, high inflation, no security in this market, with even would be seen by many as signs of

and interest rate rises are causing weaker returns than those of the at least a mild recession. A 1970s-

significant difficulties for the eurozone. equity market. At the index level, the style stagflation – a combination of

sharpest plunges were experienced by high inflation and recession – would

Fears of recession and rising interest eurozone sovereign bonds at −17.2%, lead to poor real yields and a drop in

rates affect the pricing of asset classes. and emerging markets bonds at −25.1%. asset values. The Finnish Cultural

The main question is how the inflation In the Cultural Foundation’s portfolio, Foundation’s cash reserves and

will evolve. If it starts to decline, it will fixed-income investments were budgeted expenditure framework can

probably boost the markets; if, however, focused on money market investments however secure its operations even in

it continues to accelerate and brings and short-duration corporate bonds, less prosperous years.

with it tightening interest rates, this will

lead to a deeper recession.

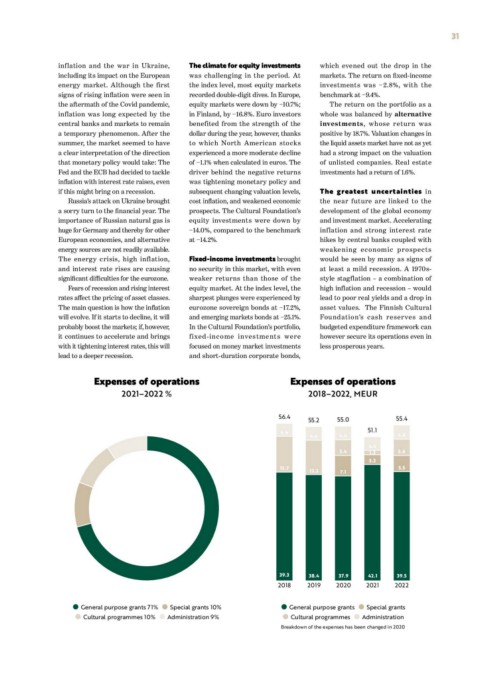

Expenses of operations Expenses of operations

2021–2022 % 2018–2022, MEUR

56.4 55.2 55.0 55.4

4.4 4.6 4.6 51.1 4.8

4.6

5.4 1.2 5.6

3.2

12.7 12.2 7.1 5.5

39.3 38.4 37.9 42.1 39.5

2018 2019 2020 2021 2022

● ●General purpose grants 71% Special grants 10% ● ●General purpose grants Special grants

● ●Cultural programmes 10% Administration 9% ● ●Cultural programmes Administration

Breakdown of the expenses has been changed in 2020