Page 22 - SKR-annual-report-2022-EN

P. 22

22 THE CULTURAL FOUNDATION’S YEAR

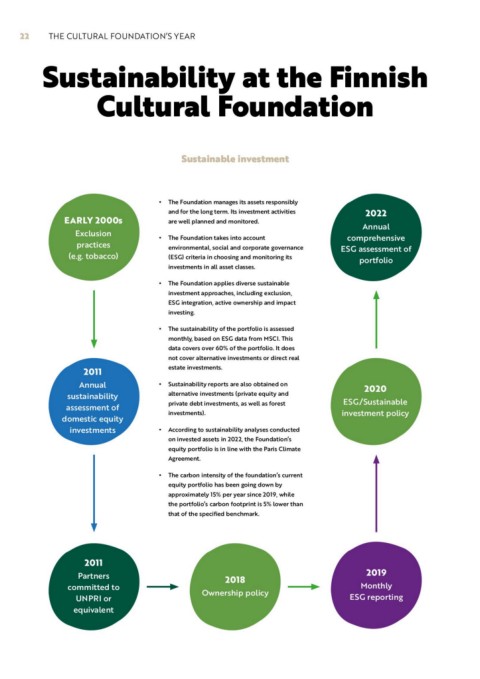

Sustainability at the Finnish

Cultural Foundation

Sustainable investment

EARLY 2000s • The Foundation manages its assets responsibly 2022

Exclusion and for the long term. Its investment activities Annual

practices are well planned and monitored. comprehensive

ESG assessment of

(e.g. tobacco) • The Foundation takes into account portfolio

environmental, social and corporate governance

2011 (ESG) criteria in choosing and monitoring its 2020

Annual investments in all asset classes. ESG/Sustainable

sustainability investment policy

assessment of • The Foundation applies diverse sustainable

domestic equity investment approaches, including exclusion,

investments ESG integration, active ownership and impact

investing.

• The sustainability of the portfolio is assessed

monthly, based on ESG data from MSCI. This

data covers over 60% of the portfolio. It does

not cover alternative investments or direct real

estate investments.

• Sustainability reports are also obtained on

alternative investments (private equity and

private debt investments, as well as forest

investments).

• According to sustainability analyses conducted

on invested assets in 2022, the Foundation’s

equity portfolio is in line with the Paris Climate

Agreement.

• The carbon intensity of the foundation’s current

equity portfolio has been going down by

approximately 15% per year since 2019, while

the portfolio’s carbon footprint is 5% lower than

that of the specified benchmark.

2011 2018 2019

Ownership policy Monthly

Partners ESG reporting

committed to

UNPRI or

equivalent